When a fast-growing industry hits a hard brake, you feel it in jobs, investments, and in the dreams of young players who thought gaming was their runway. India’s new Online Gaming Bill is that brake. It draws a bright line between “play” and “pay,” backing e-sports while banning real-money gaming. Here’s what that really means for companies, for creators, and for the millions who game every day.

What the Bill Does In Plain Words

Parliament has passed the Promotion and Regulation of Online Gaming Bill, 2025, which bans money-based online games while creating a national framework to promote and regulate e-sports, educational, and social (non-monetary) games. It also proposes a central authority for oversight and rule-making. The Bill awaits presidential assent at the time of writing.

Sources: PIB explainer, PRS: Bill text (PDF), Reuters, TechCrunch, Al Jazeera

What’s Banned vs. Backed

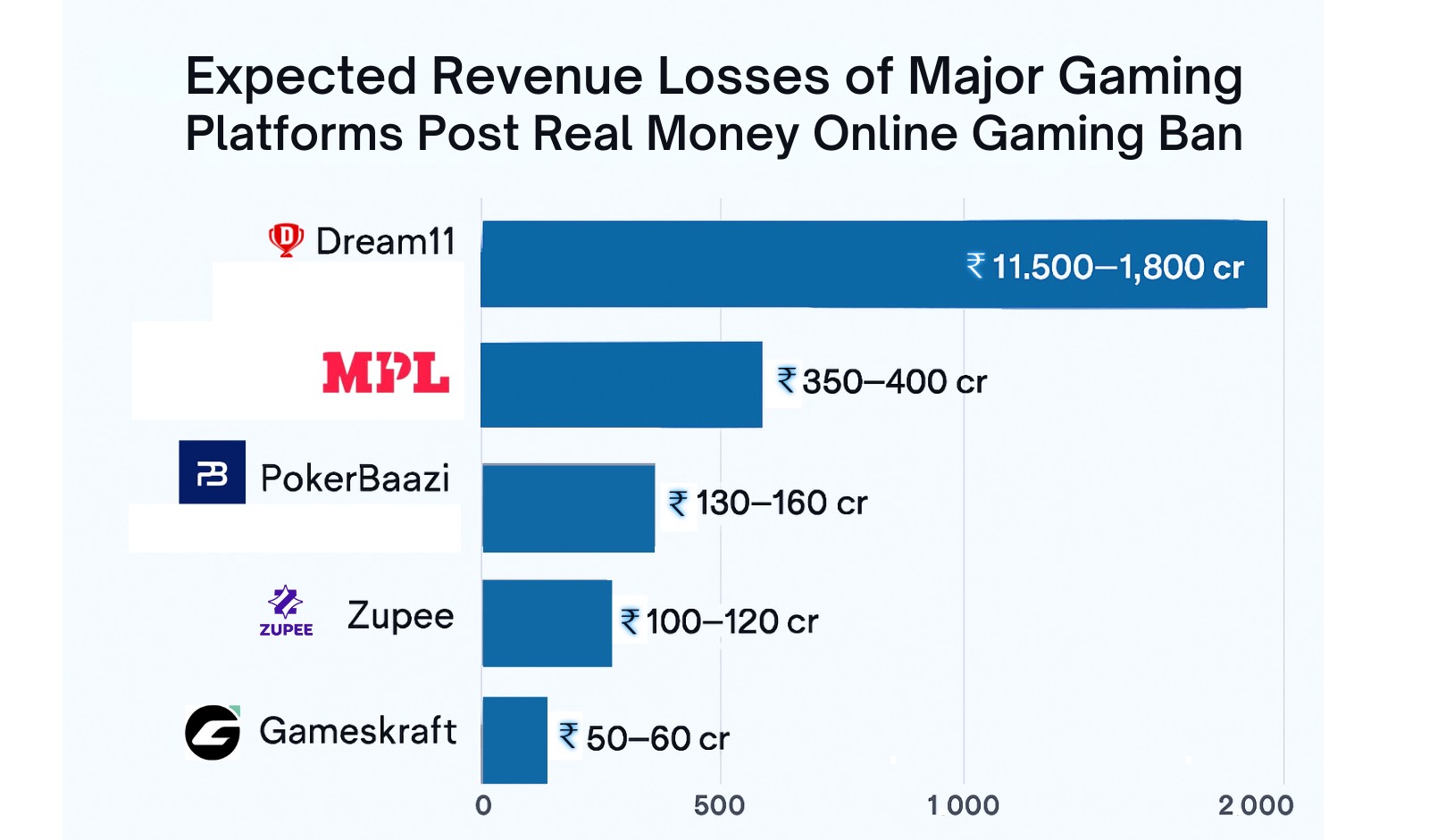

- Banned: Offering, advertising, or facilitating online real-money games (RMG) i.e., games where users stake money for monetary returns. Several leading platforms halted money gaming within hours: Dream11 (RMG features), MPL, Zupee, and others have begun winding down money-based divisions. Sources: Reuters, TechCrunch, TOI, TOI Zupee update

- Backed: E-sports, non-monetary social games, and educational games under a formal regulatory and developmental framework. This builds on India’s official recognition of e-sports in December 2022 and the extension of cash-incentive schemes to e-sports medalists and coaches in 2025. Sources: Government recognition of e-sports (PIB), Drishti IAS note

Why Now? The Backdrop: Tax, Harm, and Growth

For two years, the sector has lived with whiplash: 28% GST on deposits for online skill gaming (from October 2023), retrospective tax demands, and court challenges. The new law goes further eliminating money gaming altogether.

Sources: EY on 28% GST impact, EY report (PDF), MeitY IT Rules 2023 (PDF)

Government voices have framed the move as a public-interest necessity, citing financial harm and addiction concerns. Reportage this week referenced data that Indians lose ~₹20,000 crore annually on RMG platforms, with ~450–500 million gamers in the country.

Sources: Economic Times report, TOI data brief, FICCI-EY gamer base 2024

At the same time, GST collections from online gaming soared 412% in Oct 2023 Mar 2024 a sign of the industry’s fiscal weight even before the ban.

Source: ORF analysis

The Shockwave: What Changes on the Ground

Companies: Within a day of the vote, RMG features went dark on multiple apps. Public markets reacted; coverage notes pressure on gaming-linked equities and urgent legal reviews by firms.

Sources: Reuters, Reuters ban passed

Creators and pros: Streamers and tournament organizers tied to fantasy/RMG must pivot to e-sports and free-to-play formats. For salaried staff in RMG divisions, near-term layoffs and team closures are real risks already being reported.

Creators and Streamers with Online Money Gaming promotions

Sources: TechCrunch, TOI-shutdowns

Players: Money-gaming wallets, deposits, and withdrawals will come under strict scrutiny and blocks via payment rails and app platforms. Non-monetary games and e-sports events should continue and, in theory, grow under the new framework.

Sources: PIB explainer, Al Jazeera

The Case For the Ban (Pros)

1) Consumer protection first. The ₹20,000 crore annual loss figure is staggering, and addiction-linked harms are not abstract for families who’ve watched savings slip into “one more game.” Regulators argue that the social cost justified a decisive reset.

Sources: Economic Times, TOI

2) Clarity over chaos. The previous regime IT Rules amendments, self-regulatory bodies, state-level bans, and 28% GST created confusion and litigation. A single national law provides bright-line rules (even if harsh) and a clear runway for e-sports.

Sources: MeitY IT Rules (PDF), Cyril Amarchand analysis

3) Serious backing for e-sports. India didn’t just say “no” to RMG; it also said a bigger “yes” to e-sports recognized since 2022 and now prioritized with policy, funding signals, and medalist rewards. That’s oxygen for teams, event IP, and talent pipelines.

Sources: PIB recognition & incentives

The Case Against the Ban (Cons)

1) Jobs, startups, and capital at risk. The online gaming industry was on track for 250,000 jobs by 2025, with strong venture backing. A blanket ban on RMG could erase thousands of roles, freeze FDI, and shrink a sector that had grown at ~28% CAGR to ₹16,428 crore in FY23.

Sources: EY “New Frontiers”, Commentary on the Bill, Investment impact write-up

2) Enforcement isn’t easy. Experts warn that blocking offshore apps, payment workarounds, and black-market skins/betting is a technical and legal marathon. Without robust, coordinated enforcement, users may migrate to riskier, unregulated avenues.

Source: Indian Express explainer

3) The “skill vs chance” gray zone. India’s jurisprudence has long separated games of skill (e.g., poker, rummy, fantasy) from gambling. Critics argue that a blanket prohibition ignores this nuance and punishes compliant operators along with bad actors.

Sources: EY taxation brief, ET Commentary

The Scale of What’s at Stake

India’s gamer base is ~488 million (2024) a cultural force bigger than most sports leagues combined. The broader gaming market was ~US$4.3B in 2024 and projected to US$15.2B by 2033 growth that now must come from e-sports, casual, and creator-led ecosystems instead of RMG.

Sources: FICCI-EY 2025 snapshot, IMARC market outlook

For E-Sports: A Door Opens But Walk Through It

This is the moment for Indian e-sports to get serious about grassroots leagues, scholastic programs, athlete welfare, anti-doping & integrity codes, and broadcast-ready events. With state support and a national authority inbound, organizers can push for venues, visas, and visibility that match cricket and kabaddi’s playbooks. The emotional center here is simple: treat players like athletes and fans like community, not just “users.”

For Money-Gaming Startups: Pivot, Partner, or Pause

- Pivot to non-monetary products (skill without stakes), ad-supported formats, and brand-backed e-sports IP.

- Partner with publishers, sports leagues, and streamers to build safe, high-integrity competitions.

- Pause contested features; ensure wallet settlements, KYC, and data deletion comply with the new law and IT rules. References for compliance context: MeitY IT Rules 2023 (PDF), PRS Bill text

The Emotion Beneath the Headlines

For families burnt by losses, this law feels like relief. For founders who built teams, tech, and trust under shifting goalposts, it feels like whiplash. For athletes who’ve spent years convincing the world that e-sports is sport, it feels like recognition finally. All three truths can exist at once.

India just made a values choice: play is welcome; wagering is not. If we pair that principle with smart enforcement and serious investment in e-sports, we can protect people without dimming the creative fire that made Indian gaming what it is.

Follow the latest article on Sportspedia Zone about:

Bookmark Sportspediazone for more sporting updates and,

Stay tuned!