Indian cricket isn’t just a sport it’s a stage where national pride, corporate ambition, and billions of emotions collide. Yet, the jersey that every player wears with honor has carried a strange shadow over the years. Time and again, the brands bold enough to place their name on Team India’s chest have stumbled whether through financial collapse, regulatory hurdles, or strategic retreats. From Sahara’s empire crumbling under regulatory heat to Byju’s spectacular fall from unicorn glory, and now Dream11’s sudden exit amid new gaming laws, the story has unfolded like an unshakable pattern. Many call it coincidence. Others call it destiny. But for fans, it feels like a never-ending curse tied to Indian cricket’s Lead sponsors.

The Pattern We Don’t Want to See

Indian cricket is the heartbeat of a billion people. Yet, the brands that dare to sit on that chest front and center on the Team India jersey seem to falter, one after another. From Sahara to Dream11, the story reads like a warning: unmatched visibility, dizzying costs, soaring expectations… and then the slide. Is it coincidence? Pressure? Policy shocks? Whatever we call it, the pattern is undeniable.

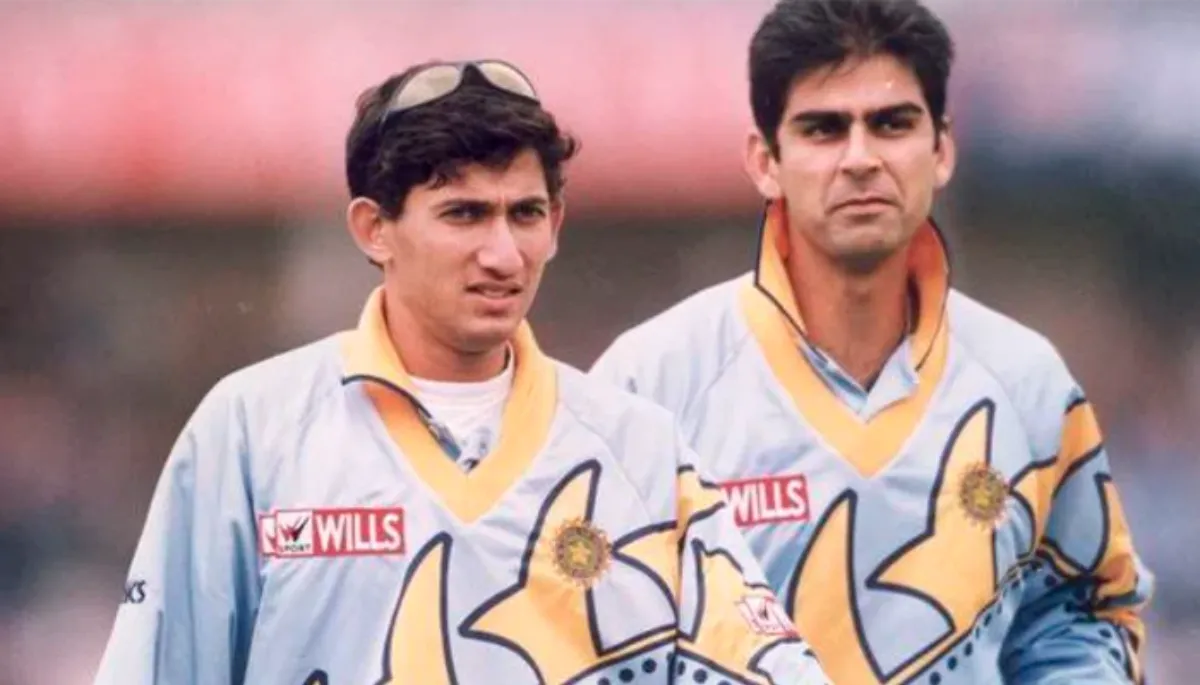

Before the Storm: Wills (1993-2002)

The jersey era began with ITC’s Wills in the 90s. It was a different country then tobacco branding still legal in sport, TV just finding scale, cricket becoming religion. When regulations tightened and the market moved on, a new age and a new kind of corporate ambition stepped in.

Sahara (2002-2013): Pride, Power… and a Fall

For more than a decade, Sahara wasn’t just a sponsor; it felt like part of the team. The logo held through heartbreak (2003) and healing (2011). But beyond the boundary, regulatory heat scorched the group. After raising roughly ₹24,000 crore from ~3 crore investors, Sahara faced SEBI action, culminating in founder Subrata Roy’s arrest in 2014. The sponsor that stood tallest eventually staggered under its own weight.

Star India (2014-2017): The Broadcast Behemoth Takes the Front

Star India moved from behind the camera to the jersey front, a power move that unified content and iconography. It was smart, sleek, and short. The deal ended quietly no scandal, no spectacle but in hindsight, it feels like the silent breath before the storm returned.

Oppo (2017-2019): Big Cheque, Brief Stay

When Oppo landed the jersey rights in March 2017, the number did the talking: ₹1,079 crore (~$156 million) for five years one of the largest jersey deals in cricket. But within two years, reality bit. Costs ballooned. Strategy shifted. Oppo handed the contract over to a hungry edtech unicorn, Byju’s, at the same financial terms for the remaining period (till March 2022).

Byju’s (2019-2023): Rocket Ship to Freefall

For a moment, it felt perfect: India’s hottest edtech on India’s hottest jersey. In June 2022, Byju’s even extended to the end of 2023 (reports pegged it near $55 million). Then the music stopped. Revenues slowed post-pandemic, audits turned messy, and dues piled up. The BCCI moved to recover unpaid sponsorship fees (~₹158 crore); insolvency proceedings flickered; eventually, a settlement was reached in July 2024 after months of bruising headlines and a collapse in valuation (from $22B in 2022 to < $3B in 2023).

Dream11 (2023-2025): Joy, Bill, Exit

July 2023: Dream11 steps in as lead jersey sponsor, reportedly ₹358 crore over three years, with per-match fees of ~₹3 crore (home) and ~₹1 crore (away). Stadium LEDs glow, TV stings fly, fantasy lineups fill. And then policy strikes. In August 2025, after India passed a sweeping Online Gaming Bill, Dream11 pulled out ahead of the Asia Cup. Overnight, the jersey risked going logo-less, with BCCI promising to follow the law to the letter.

Source: IndiaToday

The Money, The Math, The Mood

- Visibility: Team India delivers unmatched media weight weeks of live cricket, relentless clips, and a diaspora audience.

- Cost Curve: The price of that attention is brutal. From Oppo’s ₹1,079 crore headline deal to Dream11’s ₹358 crore package, the bar keeps climbing.

- Regulatory Whiplash: What markets give, policy can take fast. Edtech booms fade. Online gaming faces new rules.

And through it all, the team plays. Shubman’s straight drive doesn’t check stock prices mid-air. Bumrah’s yorker does not ask about quarterly losses. But the logo on their chest carries the invisible weight of boardrooms, regulations, and repayments. That’s the hard, human truth of big-ticket sport.

Sources: Theweek

Is It a “Curse” or a Mirror?

Call it a curse if you must; it makes for a gripping headline. But look closer: each fall mirrors a larger storm.

| Brand | Reality Behind the Downfall |

|---|---|

| Sahara | Legal enforcement – SEBI & court orders, arrests |

| Oppo | Strategic withdrawal due to poor ROI |

| Byju’s | Financial overextension, valuation collapse |

| Dream11 | Regulatory prohibition on real-money gaming |

The jersey is not cursed. It’s clarifying. It exposes fragility at scale instantly.

Sources: News24online

What the BCCI Must Do Now

- Policy-Proof the Front: Build clause-level resilience against abrupt regulatory shocks (gaming, crypto, fintech, tobacco-adjacent).

- Diversify the Face: Consider co-lead branding or category rotations to reduce concentration risk if one sector gets hit, the jersey doesn’t go blank.

- Stricter Financial Vetting: Visibility alone can’t be the filter. Liquidity, debt profile, and governance must matter more than the PR sizzle.

- Creative Inventory: Move some pressure off the chest training kits, shoulder patches, sleeve inventory, digital AR assets to keep revenue steady even if the lead slot pauses.

These are not cosmetic moves. They are guardrails for a billion-dollar sport and the children who wear that blue to bed.

The Emotion No One Wants to Admit

There’s a photo that never makes the press release: a kit man running his fingers over the empty space where a logo used to be. Sponsors come for the glare; players live with the glow. When storms hit the brands, the boys in blue still carry the weight of questions, of speculation, of optics. That’s why this story hurts. Because the jersey is not just fabric or inventory. It’s belonging.

If there is a curse, it’s this: the chest of Indian cricket demands a truth some brands are not ready to pay for not in cash, but in clarity, compliance, and courage.

Quick Timeline

Wills (1993-2002) → Sahara (2002-2013) → Star India (2014-2017) → Oppo (2017-2019) → Byju’s (2019-2023) → Dream11 (2023-2025).

Follow the latest article on Sportspedia Zone about:

Bookmark Sportspediazone for more sporting updates and,

Stay tuned!

[…] franchise geared up for WPL 2026. This approach, she credits to her time with MI, has changed her cricket […]